boxportal.ru

Overview

One Way To Eliminate Credit Card Debt

1. Contact your credit card companies · 2. Understand the two ways to pay off credit card debt · 3. Consider a debt management plan · 4. Participate in credit. There are two ways you can accelerate debt repayment to settle your outstanding balances in a shorter amount of time. 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at a time. · 4. Consolidate credit card debt. · 5. 1. Set a Goal Start by Setting a Goal You Can Achieve · 2. Put Your Credit Cards on Ice Yes, We Mean That Literally · 3. Prioritize Your Debts · 4. Trim Your. Open a 0% balance-transfer credit card: Transfer all your debts onto a single credit card and plan to pay the balance in full, or a significant chunk of it. Create a credit card repayment plan · Stop adding to your debt · Follow the debt snowball method · Follow the debt avalanche method · Find ways to earn more. Pay your husband's card first and then pay off yours. If you have a small emergency fund then stop saving that $ and put % of it to the. Each month that you carry over a balance on your credit cards, you will owe what you charged plus interest. To maintain control of this debt. 8 Tips to Manage and Reduce Credit Card Debt · 1. Continue to Pay Your Credit Card Bills on Time · 2. Practice Responsible Spending · 3. Choose a Credit Card. 1. Contact your credit card companies · 2. Understand the two ways to pay off credit card debt · 3. Consider a debt management plan · 4. Participate in credit. There are two ways you can accelerate debt repayment to settle your outstanding balances in a shorter amount of time. 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at a time. · 4. Consolidate credit card debt. · 5. 1. Set a Goal Start by Setting a Goal You Can Achieve · 2. Put Your Credit Cards on Ice Yes, We Mean That Literally · 3. Prioritize Your Debts · 4. Trim Your. Open a 0% balance-transfer credit card: Transfer all your debts onto a single credit card and plan to pay the balance in full, or a significant chunk of it. Create a credit card repayment plan · Stop adding to your debt · Follow the debt snowball method · Follow the debt avalanche method · Find ways to earn more. Pay your husband's card first and then pay off yours. If you have a small emergency fund then stop saving that $ and put % of it to the. Each month that you carry over a balance on your credit cards, you will owe what you charged plus interest. To maintain control of this debt. 8 Tips to Manage and Reduce Credit Card Debt · 1. Continue to Pay Your Credit Card Bills on Time · 2. Practice Responsible Spending · 3. Choose a Credit Card.

What to Do ; Strategy 1: Pay Off the Smallest Balance First · List your credit cards from lowest balance to highest. Pay only the minimum payment due on the cards. Make a list of who you owe, how much you owe, the interest rates, minimum payments and due dates. After you have all the information laid out in front of you. How can I pay off my credit card debt? · Pay it back gradually · Try to pay at least the minimum payment if you can. · Plan your spending · Make a budget plan. You. Debt settlement companies encourage you to stop paying credit card bills and instead require regular payments into a third-party account they manage. You may also want to work with a debt relief or settlement company to help you reduce the amount of outstanding debt. What Is the Best Way to Reduce Your Credit. This is usually done by taking out new financing, such as a balance transfer credit card or debt consolidation loan. However, if you can't consolidate on your. Making the minimum payment on a credit card can be a recipe for never-ending debt. That's because even if you pay enough to avoid late fees, you'll still be. How to pay off credit cards in 7 steps · 1. Stop using your credit cards. · 2. Get a realistic fix on your debt. · 3. Begin the month with a budget. · 4. Make. How to get rid of your credit card debt · 1. If you're in a bind, talk to your credit card issuer · 2. Identify the cause of your credit card debt · 3. Choose a. Apply for a Debt Consolidation Loan If you have a good credit score, you may be able to use a debt consolidation loan to streamline your monthly debt. How to pay off credit cards in 7 steps · 1. Stop using your credit cards. · 2. Get a realistic fix on your debt. · 3. Begin the month with a budget. · 4. Make. Startegy 1: Start with the highest interest rate first This is the fastest and most cost-effective method to reduce credit card debt because you focus on high. Trying to eliminate all of your debt? Keeping credit accounts open, and paying the balances in full every month, may help you maintain or increase your credit. Cut Monthly Bill Costs - Paying a high monthly cost for your phone, utilities and other necessary bills can add up. · Pay Less Interest Overall - A high interest. How do I pay off credit card debt? · Start by understanding your finances: Work out your monthly budget and follow it · Add a rainy-day fund to your budget · Set. 5 Steps To Assess Your Spending · Commit to a Payment Amount · Choose a Payment Strategy · Consider Balance Transfer Credit Cards · Research Debt Consolidation. 1. Make a Promise to Yourself · 2. Make a list of bad and good debts · 3. Consolidate credit cards · 4. Start with the highest interest “bad debt” card · 5. Ask for. Each month that you carry over a balance on your credit cards, you will owe what you charged plus interest. To maintain control of this debt. A personal loan for debt consolidation is another excellent choice for many people. Still, any approach to reducing credit card debt will start with these same.

Fidelity Freedom 2060 K

FNSFX Performance - Review the performance history of the Fidelity Freedom K fund to see it's current status, yearly returns, and dividend history. See Fidelity Advisor Freedom® Fund (FDKPX) mutual fund ratings from all the top fund analysts in one place. See Fidelity Advisor Freedom® Fund. Fidelity Freedom K FNSFX · NAV / 1-Day Return / + % · Total Assets Bil · Adj. Expense Ratio. % · Expense Ratio % · Distribution Fee. Fidelity Freedom Blend K (FHTDX) is an actively managed Allocation Target-Date fund. Fidelity Investments launched the fund in The investment. Fidelity Freedom K (FNSFX). Type. Open-end mutual fund. Manager. Fidelity Investments. Target date. Fidelity Freedom Series. Target date funds are pretty good set and forget investment that will auto re-balance for you as you age to retirement. That fund is well. Fidelity Advisor Mutual Funds · Fidelity Mutual Funds · Fidelity ETFs · Fidelity Money Market Funds · Model Portfolios · Separately Managed Accounts · Shareclass ticker. FNSFX. Data as of ; Shareclass name. Fidelity Freedom K · % of fund assets screened ; Shareclass type. Open-end funds. Fund net assets. The investment seeks high total return until its target retirement date. The fund invests in a combination of Fidelity® US equity funds, international equity. FNSFX Performance - Review the performance history of the Fidelity Freedom K fund to see it's current status, yearly returns, and dividend history. See Fidelity Advisor Freedom® Fund (FDKPX) mutual fund ratings from all the top fund analysts in one place. See Fidelity Advisor Freedom® Fund. Fidelity Freedom K FNSFX · NAV / 1-Day Return / + % · Total Assets Bil · Adj. Expense Ratio. % · Expense Ratio % · Distribution Fee. Fidelity Freedom Blend K (FHTDX) is an actively managed Allocation Target-Date fund. Fidelity Investments launched the fund in The investment. Fidelity Freedom K (FNSFX). Type. Open-end mutual fund. Manager. Fidelity Investments. Target date. Fidelity Freedom Series. Target date funds are pretty good set and forget investment that will auto re-balance for you as you age to retirement. That fund is well. Fidelity Advisor Mutual Funds · Fidelity Mutual Funds · Fidelity ETFs · Fidelity Money Market Funds · Model Portfolios · Separately Managed Accounts · Shareclass ticker. FNSFX. Data as of ; Shareclass name. Fidelity Freedom K · % of fund assets screened ; Shareclass type. Open-end funds. Fund net assets. The investment seeks high total return until its target retirement date. The fund invests in a combination of Fidelity® US equity funds, international equity.

Fidelity Freedom Fund. Shareclass. Fidelity Freedom K (FNSFX). Type. Open-end mutual fund. Manager. Fidelity Investments. Target date. Fidelity. FNSFX: Fidelity Freedom Fund: Class K - Fund Profile. Get the lastest Fund Profile for Fidelity Freedom Fund: Class K from Zacks Investment. Should you invest in Fidelity Freedom K FNSFX? boxportal.ru provides easy-to-understand data on Fidelity Freedom K FNSFX and more than other. Fidelity Freedom Fund;K advanced mutual fund charts by MarketWatch. View FNSFX mutual fund data and compare to other funds, stocks and exchanges. The fund invests in a combination of Fidelity® U.S. equity funds, international equity funds, bond funds, and short-term funds (underlying Fidelity® Funds). Fidelity Freedom K® Funds offer a single-fund approach to choosing and managing workplace savings plan investments. In fact, it couldn't be simpler. All you. Latest Fidelity Freedom Fund - Class K (FNSFX) share price with interactive charts, historical prices, comparative analysis, forecasts. Fidelity Freedom K (FNSFX) is an actively managed Allocation Target-Date fund. Fidelity Investments launched the fund in The investment seeks. Find the latest performance data chart, historical data and news for Fidelity Freedom Fund: Class K (FNSFX) at boxportal.ru Get the latest Fidelity Freedom Fund - Class K (FNSFX) stock price quote with financials, statistics, dividends, charts and more. Institutional Investor Accounts Portal · Liquidity Management Accounts · Fidelity Funds - Class K. Please wait. Select a different fund. {{productLineLongName}}. Sustainability. Nasdaq - Delayed Quote • USD. Fidelity Freedom K (FNSFX). Follow. (%). At close: September 4 at AM EDT. Fund Summary. Analyze the Fund Fidelity Freedom ® Index Fund Investor Class having Symbol FDKLX for type mutual-funds and perform research on other mutual funds. K. Currency. USD. Domiciled Country. US. Manager. Andrew Dierdorf. Fund Description. Investing primarily in a combination of Fidelity® U.S. equity funds. Performance charts for Fidelity Freedom K Fund (FDKNX) including intraday, historical and comparison charts, technical analysis and trend lines. Fidelity Freedom Fund. Rank: 10 of Target-Date · K. Active Fund. Active Fund. USD, %. Target date funds can be used to help build and maintain an age-appropriate retirement investment strategy. The investment seeks high total return until its target retirement date. The fund invests in a combination of Fidelity® U.S. equity funds. Get Fidelity Freedom Fund - Class K (FNSFX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Fidelity Freedom Fund. Shareclass. Fidelity Freedom K (FNSFX). Type. Open-end mutual fund. Manager. Fidelity Investments. Target date. Fidelity.

Marcus Online Savings Bonus

Marcus / Goldman Sachs High Yield Savings Account Referral Bonus - ADDITIONAL +1% APY & more (up to %) (January ). When a referred friend opens a new Marcus Online Savings Account or CD and meets the eligibility requirements, both the referrer and the new customer receive a. Deal Summary: $ bonus when depositing at least $10k of new funds in a new or existing Online Savings Account. Availability: Nationwide (internet bank). Best for no fees: Marcus by Goldman Sachs High Yield Online Savings; Best for Best for welcome bonus: SoFi Checking and Savings; Best if you want. How do I make my initial deposit to my Investor Savings account? Transfer funds to your savings account online from a Schwab One® brokerage account or. Earn up to % APY 2 and collect up to a $ cash bonus with direct deposit or $5, or more in qualifying deposits. 3 FDIC Insured. 4. Learn More. Marcus. Marcus by Goldman Sachs - No longer offering 1% referral bonus effective July 01 Now%. News. Marcus by Goldman Sachs offers financial products to help you make the most of your money. GROW AND MANAGE YOUR SAVINGS Earn competitive rates on Online. Their online savings accounts feature no minimum initial deposits to open. Their CDs feature relatively low initial deposit requirements, as well as. Marcus / Goldman Sachs High Yield Savings Account Referral Bonus - ADDITIONAL +1% APY & more (up to %) (January ). When a referred friend opens a new Marcus Online Savings Account or CD and meets the eligibility requirements, both the referrer and the new customer receive a. Deal Summary: $ bonus when depositing at least $10k of new funds in a new or existing Online Savings Account. Availability: Nationwide (internet bank). Best for no fees: Marcus by Goldman Sachs High Yield Online Savings; Best for Best for welcome bonus: SoFi Checking and Savings; Best if you want. How do I make my initial deposit to my Investor Savings account? Transfer funds to your savings account online from a Schwab One® brokerage account or. Earn up to % APY 2 and collect up to a $ cash bonus with direct deposit or $5, or more in qualifying deposits. 3 FDIC Insured. 4. Learn More. Marcus. Marcus by Goldman Sachs - No longer offering 1% referral bonus effective July 01 Now%. News. Marcus by Goldman Sachs offers financial products to help you make the most of your money. GROW AND MANAGE YOUR SAVINGS Earn competitive rates on Online. Their online savings accounts feature no minimum initial deposits to open. Their CDs feature relatively low initial deposit requirements, as well as.

Get $ when you enroll and deposit $ or more in new funds into a new or existing Online Savings Account. You must first enroll, then deposit within. AARP membership gives you access to banking, investments, and financial planning resources like tax help, savings accounts, annuities and money tools. When a referred friend opens a new Marcus Online Savings Account or CD and meets the eligibility requirements, both the referrer and the new customer receive a. This lower overhead lets online banks offer some unique perks, like waiving common fees and, sometimes, no minimum deposit requirements. As attractive as these. Maximum bonus eligibility is $ What to know: Offer not valid for existing or prior Discover savings customers, including co-branded, or affinity accounts. Special Offer: $ Cash Bonus Get $ when you deposit $ or more in new funds into a new or existing Online Savings Account. Members can open an 8-month No-Penalty CD online in minutes with no fees and lock in a higher interest rate than what's available with a Marcus Online Savings. Goldman Sachs offers a surprisingly good high-yield online savings account with its Marcus Savings Account, currently offering a % annual percentage. UFB Direct is an online bank and a division of the more widely known Axos Bank. Its branchless, online-only model allows it to keep costs down and offer some of. For example, the Marcus by Goldman Sachs High-Yield Online Savings Account has no monthly fees or minimum deposit and earns a competitive % APY. And with. Marcus by Goldman Sachs is offering a special $ cash bonus when you enroll and deposit $10, or more in new funds into a new or existing Online Savings. How Marcus savings interest rates compare with top-yielding online banks The high-yield online savings account offered by Marcus is competitive, though some. Customers can earn $5 a month ($60 a year) by depositing at least $ each month for a year in a new Savings Builder account. Existing accounts aren't eligible. Marcus high-yield online savings accounts pay a competitive interest rate that's promoted as four times the national average. The savings account charges no. Does Goldman Sachs Bank USA offer a signup bonus? Marcus by Goldman Sachs Savings doesn't offer a signup bonus. What is the minimum initial deposit for. Chase. Chase Savings · PNC Bank. Standard Savings · Bank of America. Advantage Savings · Ally Bank. Online Savings Account · Citibank. Citi Savings - Access Account. % APY. · NO FEES and NO Minimum deposit. · There is a limit of six withdrawals or transfers in a monthly statement period from a Marcus Online Savings Account. Check out our High Yield Savings accounts and use our calculator to compare our rates to your bank's rates. The Marcus by Goldman Sachs High-Yield Online Savings Account offers a % annual percentage yield (APY), which is nearly 10 times higher than the national. Marcus by Goldman Sachs offers financial products to help you make the most of your money. GROW AND MANAGE YOUR SAVINGS Earn competitive rates on Online.

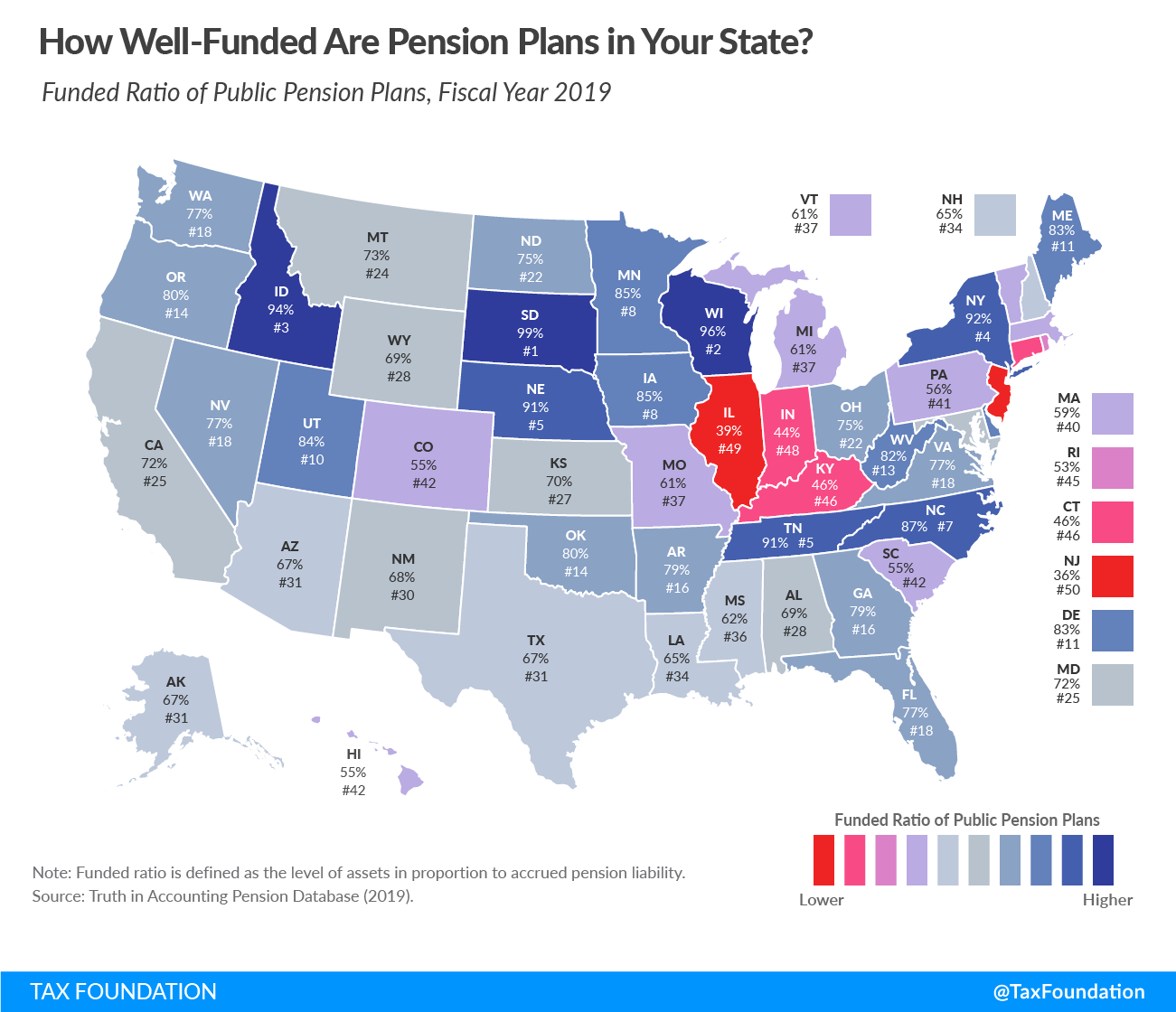

Pension Tax Rate

Eligible retirees can claim a retirement tax credit of up to $ Tax on Taxable Income: Flat rate of %. Social Security: Taxable; Pensions: Taxable; (k). If you're age 55 or younger · taxable — taxed at your marginal tax rate. The highest rate of tax a taxpayer will pay on their income. Find out your marginal tax. 9%. Once you're retired and are no longer receiving a paycheck or generating income as a self-employed individual, you'll no longer pay FICA or self-employment. When you take money from a pension pot, 25% of it is usually tax free (up to a maximum of £, unless you have protection for a higher amount). The rest . Pensions ; (ii) Person on parent rates: Tax rebate = (taxable pension income less 10,) X 15% ; (iii) (a) Person on married rates: Tax rebate = (taxable. Generally, deferred compensation income is not included in the definition of retirement and pension benefits and therefore, does not qualify for special tax. Social Security Benefits: Depending on provisional income, up to 85% of Social Security benefits can be taxed by the IRS at ordinary income tax rates. Pensions. As a resident of Delaware, the amount of your pension and K income that is taxable for federal purposes is also taxable in Delaware. However, person's Generally, pension and annuity payments are subject to Federal income tax withholding. The withholding rules apply to the taxable part of payments or. Eligible retirees can claim a retirement tax credit of up to $ Tax on Taxable Income: Flat rate of %. Social Security: Taxable; Pensions: Taxable; (k). If you're age 55 or younger · taxable — taxed at your marginal tax rate. The highest rate of tax a taxpayer will pay on their income. Find out your marginal tax. 9%. Once you're retired and are no longer receiving a paycheck or generating income as a self-employed individual, you'll no longer pay FICA or self-employment. When you take money from a pension pot, 25% of it is usually tax free (up to a maximum of £, unless you have protection for a higher amount). The rest . Pensions ; (ii) Person on parent rates: Tax rebate = (taxable pension income less 10,) X 15% ; (iii) (a) Person on married rates: Tax rebate = (taxable. Generally, deferred compensation income is not included in the definition of retirement and pension benefits and therefore, does not qualify for special tax. Social Security Benefits: Depending on provisional income, up to 85% of Social Security benefits can be taxed by the IRS at ordinary income tax rates. Pensions. As a resident of Delaware, the amount of your pension and K income that is taxable for federal purposes is also taxable in Delaware. However, person's Generally, pension and annuity payments are subject to Federal income tax withholding. The withholding rules apply to the taxable part of payments or.

A mandatory 20% federal tax withholding rate is applied to certain lump-sum paid benefits, such as the Basic Death Benefit, Retired Death Benefit, Option 1. Generally, deferred compensation income is not included in the definition of retirement and pension benefits and therefore, does not qualify for special tax. To see tax rates from /5, see the Archive – Tax Rates webpage. Retirement fund lump sum withdrawal benefits consist of lump sums from a pension. your pension provider claims tax relief from the government at the basic 20% rate and adds it to your pension pot ('relief at source'). If your rate of Income. Both your income from these retirement plans and your earned income are taxed as ordinary income at rates from 10% to 37%.5 And if you have an employer-funded. Do you pay tax on your pension? How tax is paid on pensions; Income from more The tax rate you pay increases when your income goes over the income tax. However, there are no estate or inheritance taxes in Idaho. Income Tax on Taxable Income: % flat tax rate. Social Security: Not taxable; Pensions: Partially. If you are a full-year resident of Wisconsin, generally the same amount of your pension and annuity income that is taxable for federal tax purposes is taxable. Distributions from qualified pension plans as described in Treasury tax from these payments at the rate of 5 percent. Iowa income tax was. NYS Pension Taxation Requirements By State ; Arkansas, Yes, Yes ; California, Yes, Yes ; Colorado, Yes, Yes ; Connecticut, Yes, Yes. Is pension income taxable? Find out if pension income, which is a source of retirement income from an employer, is taxed in this post from H&R Block. Employers of most pension plans are required to withhold a mandatory 20% of your lump sum retirement distribution when you leave their company. A pension loan from a retirement plan is a loan that is not reportable as income. Military Personnel & Veterans. Military Pensions or Survivor Benefits. New. Sales Tax Rate Lookup · Grocery Tax · Sales Tax Exemptions · Accelerated Sales Tax Pensions; (k), (b), and similar investments; Tier 2 Railroad. Information updated 2/24/ State, Income Tax, Tax NY Pension, Tax IRC 's or. Deferred Comp. Pension Tax Year FAQs For all tax years beginning on or after January 1, , the Missouri adjusted gross income limitation based on filing status will. However, if your retirement income is over the $10, deduction, it is subject to South Carolina's regular income tax rates. These rates range from 0% to a. If you're wondering, “What pensions are not taxable?” Here's the answer: You don't pay tax on the portion of the pension payments that represent a return of the. Sales Tax Rate Lookup · Grocery Tax · Sales Tax Exemptions · Accelerated Sales Tax Pensions; (k), (b), and similar investments; Tier 2 Railroad.

Tradebloc Credit Repair

Recommended Reviews - Tradebloc · Map · Commerce St. Dallas, TX West End, Downtown · () Call Now · More Info. Hours · From the Business. Name: Gotham Services LLC, # 1 · Timothy K Anderson ; Name: Credit Innovations, # 2 · Scott Been ; Name: Credit Repair USA, # 3 · Scott Been ; Name: Credit. This latest vision, Tradebloc was founded in and provides a complete list of credit and debt management options for their clients including Credit. Credit Monitoring, Debt Negotiations, Debt Settlement and overall Debt Relief for consumers. credit repair services. Tradebloc is now excited to announce. Something great about our company is we offer credit protection while we cancel your timeshare & credit repair. #timesharecancellation #timeshare. Tradebloc, Inc® is recognized as a top leader in credit repair and identity theft monitoring with consecutive years of triple-digit growth. Credit monitoring by IdentityIQ will help you raise your credit score. New account alerts, New cleared user alerts, Score change alerts. Who is Tradebloc. Tradebloc, Inc® is recognized as a top leader in credit repair and identity theft monitoring with consecutive years of triple-digit growth. Call us anytime you have a question regarding your services or credit. In exchange, I,., agree to pay the following fees: Authorization for Credit Repair. Recommended Reviews - Tradebloc · Map · Commerce St. Dallas, TX West End, Downtown · () Call Now · More Info. Hours · From the Business. Name: Gotham Services LLC, # 1 · Timothy K Anderson ; Name: Credit Innovations, # 2 · Scott Been ; Name: Credit Repair USA, # 3 · Scott Been ; Name: Credit. This latest vision, Tradebloc was founded in and provides a complete list of credit and debt management options for their clients including Credit. Credit Monitoring, Debt Negotiations, Debt Settlement and overall Debt Relief for consumers. credit repair services. Tradebloc is now excited to announce. Something great about our company is we offer credit protection while we cancel your timeshare & credit repair. #timesharecancellation #timeshare. Tradebloc, Inc® is recognized as a top leader in credit repair and identity theft monitoring with consecutive years of triple-digit growth. Credit monitoring by IdentityIQ will help you raise your credit score. New account alerts, New cleared user alerts, Score change alerts. Who is Tradebloc. Tradebloc, Inc® is recognized as a top leader in credit repair and identity theft monitoring with consecutive years of triple-digit growth. Call us anytime you have a question regarding your services or credit. In exchange, I,., agree to pay the following fees: Authorization for Credit Repair.

Hello, I am Tim Clark. I am from the United States. I am CEO of Tradeboc, a credit repair Industry. Tradebloc provides a complete list of debt relief. Tradebloc is founded in by Tim Clark, who has been working in the credit and debt management industry for over 25 years. Show more. Credit Monitoring. The Millionaires Club exists to provide recognition to those who took action, changed a lot of lives, and grossed 1,, revenue using Credit Repair. Credit Credit Repair. Miami, FL. Jose Rodriguez. Clean Slate Credit Solutions Trade Bloc Inc. Dallas, TX. Alain Enriquez, Ivan Meza,. Earl Craig, John. I have been in the credit repair industry for 22 years and helped over 50, clients achieve their goals of a perfect score. Currently, I am the credit repair. Any information regarding Tradebloc with Seaside consultant for credit • Craig Pace - offered credit repair services for a fee, including. Master Credit has helped over clients get out of debt. Credit Guard, founded in , was voted “Nation's Best Credit Repair Company.” Credit Guard was. Get information, directions, products, services, phone numbers, and reviews on Tradebloc Prosperity Credit Repair, LLC. Dallas, TX. Call View. Detailed. Name: Tradebloc Inc. # 8. Contact: Timothy D. Clark. Location: Commerce Name: H & H Credit Repair Services, # Contact: Himilee Hamelius. Credit Guard, founded in , was voted “Nation's Best Credit Repair Company.” Credit Guard was licensed, registered, and bonded and an Accredited Member of. I hired Tradebloc to cancel a timeshare and they were able to get that done in 4 months. Now I am considering them for credit repair. (d) Tradebloc Inc. will initiate contact with all creditors requested by the client along with the three major credit bureaus: Experian, TransUnion, and Equifax. does anyone know anything about this credit repair and block company called Tradebloc? Are they legit or just a scam company? Tradebloc Capital; Tradebloc Credit Repair; Tradebloc Marketing; Tradebloc Music. These sites still offer comparable information to the primary site. By all. Tradebloc Tim Clark provides dedicated credit repair services, helping improve your credit score through effective monitoring, negotiation, and debt management. All in all, the company is recommended for credit repair skills, customer care, and timeshare termination skills. Several customers documented their. Dear Credit Minded, I have been in the credit repair industry for a decade and helped over 20, clients achieve their goals of a perfect score. I was recently introduced to company called Tradebloc that does credit repair. They told me I could private label all of their docs charge me a flat fee per. credit repair identity monitoring travel club travel fulfillment debt settlement bankruptcy services credit counseling debt relief. Tradebloc Inc Reviews.

How Much Is Income Tax Preparation

E-file your federal and state taxes online with TaxAct. Explore tax products for a wide range of tax filing situations and get your maximum tax refund. income tax return; however, people with a modest income have a vested interest in filing income tax. Many programs and benefits from the governments of New. Choose your ProFile products ; Federal Tax Suite · $2, $2, ; T1 & T2/CO Bundle. $1, $1, ; T1: Personal. $ $ ; T3: Trusts. $ ; FX. United States Individual Returns: ; & , Net Investment Income Tax (NIIT), $ ; W-7, Application for IRS Individual Taxpayer Identification number, $ The IRS Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) programs prepare tax returns for free for qualifying taxpayers. Program Info. Get Free Tax Prep Help The IRS Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) programs offer free tax. Student. $ FLAT RATE. (Remote Filing Only) ; Employed. $ STARTING. More Rates at the bottom to find out more ; Rental Prop. $ STARTING. Click More Rates. Program Info. Get Free Tax Prep Help The IRS Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) programs offer free tax. Income Tax Preparation ; Student Return. $68 · Enrolled in school ; Basic Return. $ · Submitting 5 or fewer forms ; Basic Plus. $ · Employed by a company. E-file your federal and state taxes online with TaxAct. Explore tax products for a wide range of tax filing situations and get your maximum tax refund. income tax return; however, people with a modest income have a vested interest in filing income tax. Many programs and benefits from the governments of New. Choose your ProFile products ; Federal Tax Suite · $2, $2, ; T1 & T2/CO Bundle. $1, $1, ; T1: Personal. $ $ ; T3: Trusts. $ ; FX. United States Individual Returns: ; & , Net Investment Income Tax (NIIT), $ ; W-7, Application for IRS Individual Taxpayer Identification number, $ The IRS Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) programs prepare tax returns for free for qualifying taxpayers. Program Info. Get Free Tax Prep Help The IRS Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) programs offer free tax. Student. $ FLAT RATE. (Remote Filing Only) ; Employed. $ STARTING. More Rates at the bottom to find out more ; Rental Prop. $ STARTING. Click More Rates. Program Info. Get Free Tax Prep Help The IRS Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) programs offer free tax. Income Tax Preparation ; Student Return. $68 · Enrolled in school ; Basic Return. $ · Submitting 5 or fewer forms ; Basic Plus. $ · Employed by a company.

Free tax preparation services are available for low- to moderate-income taxpayers through a number of trusted programs. Tax Preparation expertise you can count on: · with NY: $+ · Schedule C: $1,+ · , F with NY & NYC: $2,+ · S, with NY & NYC. We simplify and manage the entire prep and filing of your indirect taxes (GST/HST, PST, VAT). Calculate your annual federal and provincial combined tax rate. Free tax preparation services are available for low- to moderate-income taxpayers through a number of trusted programs. Some tax preparation services have set prices, while others, such as professional accountants, can cost up to thousands of dollars. Other services that are. If you are living with low income and have a simple tax situation, you can file your income tax for free, year-round. Why is filing taxes important? Residents. There are many free tax filing services available through partnership with the Community Volunteer Income Tax Program/CRA trained volunteers- see listing below. The average cost of tax preparation by CPAs by form ; Form (not itemized), $, $ ; Form (itemized), $, $ ; Form (Gift Tax), $ Earn extra money by becoming a registered tax preparer or learn to prepare taxes for personal use. Upon completion of this course, you will be able to complete. Your federal tax rates are based on your income level and filing status. The percentages and income brackets can change annually. Liberty Tax Canada offers professional tax preparation at + locations and online tax filing. Get your maximum tax refund GUARANTEED at Liberty Tax. Tax returns with multiple rental properties, businesses, multiple states, foreign income or other complexities usually cost $1, - $2, to prepare. How our. Purchasing tax accounting software can be a less expensive option; it can be free (for simple returns), and for more complex filing options, it will generally. As you'll see if you visit the BLS tax preparer page, the mean hourly wage for professional tax preparers comes in at $ per hour, and the mean annual wage. The average cost of tax preparation by CPAs by form ; Form (not itemized), $, $ ; Form (itemized), $, $ ; Form (Gift Tax), $ The IRS Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) programs prepare tax returns for free for qualifying taxpayers. So, while many first-year tax preparers may claim a starting salary around the $50,, year one staff might be somewhere between $30,$40, at a different. E-file your federal and state taxes online with TaxAct. Explore tax products for a wide range of tax filing situations and get your maximum tax refund. So, while many first-year tax preparers may claim a starting salary around the $50,, year one staff might be somewhere between $30,$40, at a different. Usually, an average tax return costs between $ and $ For small businesses, the fee tends to be between $ and $1, However, you can contact us to.

Best Way To Study Programming

Internet is not only the best way to learn programming but there are other resources like books and ebooks to study. 14th Sep , PM. //Fpharbhulourz. But we get it — learning to code can be intimidating. In this article, we'll walk you through the basics of how to learn coding if you're older. Along the way. One good way is to follow along a university course: watch the lectures, read the materials, do the homeworks. The Stanford Engineering. One of the most effective ways to learn code is to write it out by hand in a notebook or whiteboard. This learning approach can help you acquire programming. Bottom Line: Codea is a professional tool that has enough help features that kids can learn programming hands-on. Grades: 8– Price: Paid. Get. 1, Python for Everybody Specialization, Coursera ; 2, Learn Python 3, Codecademy ; 3, The Complete JavaScript Course From Zero to Expert! Udemy ; 4, C#. The best way to start is by strengthening your problem solving skills and then learning how to solve problems with code. Once you do that, you. Coding bootcamps are an excellent choice for learning programming if you want to build something specific or get a programming job quickly. In general. Where Can You Find Video Tutorials? Video tutorials are many coders' preferred way to learn programming, and they're abundant on the web. Treehouse is a great. Internet is not only the best way to learn programming but there are other resources like books and ebooks to study. 14th Sep , PM. //Fpharbhulourz. But we get it — learning to code can be intimidating. In this article, we'll walk you through the basics of how to learn coding if you're older. Along the way. One good way is to follow along a university course: watch the lectures, read the materials, do the homeworks. The Stanford Engineering. One of the most effective ways to learn code is to write it out by hand in a notebook or whiteboard. This learning approach can help you acquire programming. Bottom Line: Codea is a professional tool that has enough help features that kids can learn programming hands-on. Grades: 8– Price: Paid. Get. 1, Python for Everybody Specialization, Coursera ; 2, Learn Python 3, Codecademy ; 3, The Complete JavaScript Course From Zero to Expert! Udemy ; 4, C#. The best way to start is by strengthening your problem solving skills and then learning how to solve problems with code. Once you do that, you. Coding bootcamps are an excellent choice for learning programming if you want to build something specific or get a programming job quickly. In general. Where Can You Find Video Tutorials? Video tutorials are many coders' preferred way to learn programming, and they're abundant on the web. Treehouse is a great.

Python. Python is always recommended if you're looking for an easy and even fun programming language to learn first. Rather than having to jump into strict. Buy or borrow a book. There are thousands of instructional books available for every conceivable programming language. While your knowledge should not come. The best way to learn code is to take an interactive online course and combine it with coding practice. You can also use a textbook as a reference while you are. Even focusing on just one, to learn key functionality, will help you gain a better understanding of how the others work, adding value to your skill set. 6. Web. While not always fun, recalling (ideas, facts, concepts) is one of the most effective methods in studying. Recall tools are effective for. 11 Beginner Tips for Learning Python Programming · Make It Stick. Tip #1: Code Everyday; Tip #2: Write It Out; Tip #3: Go Interactive! · Make It Collaborative. Work on real projects. The best way to learn Python is by using it. Working on real projects gives you the opportunity to apply the concepts you've learned and. Platforms like Codecademy, Coursera, freeCodeCamp, Udemy and Khan Achademy provide structured learning paths and tutorials that cater to various. One of the best ways to do this is by structuring tasks, identifying resources, setting goals, tracking progress, and breaking down problems. This builds up. Find the program that's right for you · There are many coding languages; you'll need to determine which languages you want to learn. · You can learn to code at. Try Writing Code on Paper Though it might sound quite ridiculous, practising coding by writing on paper can help you learn and master programming faster than. How to Learn to Code, Fast · Be clear about your goals · Understand how you learn best · Work on something that matters to you · Find good company · Be consistent. Best for Free Coding With Paid Options. Codecademy · Many free courses; Exercises include building real websites ; Best for Overall Coding Education. Treehouse · A. You learn programming by doing — there's no way around it. You can read up on all the concepts and syntax necessary to write functional code. Learn Programming is the easiest, most interactive way to learn & practice programming online. Learn in an interactive environment. If you want to learn programming, look for course / books called learning programming with, not learning programming in. Personally if you want to learn. The best way to learn to code is to actually code. Write small programs to practice the concepts learned. Once more comfortable, begin working on larger. With the right motivation, anyone can become highly proficient in Python programming. As a beginner, I struggled to keep myself awake when trying to memorize. Instead of teaching a specific programming language, this course teaches programming fundamentals that can be helpful for any language you learn. Skills you'll. There are many free coding resources online, including Mozilla's Developer Network, Stack Exchange, and Try Ruby to learn more about programming and test your.

Single Income Limit For Roth Ira

You can contribute the full amount as a single if your income is less than $, However, if you are married your combined income must be. Income phase-out ranges that determine Roth individual retirement contributions. Roth IRA Contribution Limits Modified Adjusted Gross Income Phase-Out Ranges*. For , the total contributions you make each year to all of your traditional IRAs and Roth IRAs can't be more than: $7, ($8, if you're age 50 or older. It doesn't matter if you're covered by an employer's retirement plan, such as a (k) or (b). As long as you don't exceed the IRS's income limits, you can. Both spouses may contribute according to IRS limits, but a spousal IRA has only one legal account holder. Spousal Roth IRA income limits are set by the IRS. Roth IRA MAGI Limits ; Filing Status. Modified Adjusted Gross Income (MAGI). Contribution Limit ; Single or Head of Household. Less than $, Full. The maximum amount you can contribute to a Roth IRA for is $7, (up from $6, in ) if you're younger than age If you're age 50 and older, you. The combined annual contribution limit for Roth and traditional IRAs for the tax year is $7,, or $8, if you're age 50 or older. Those limits reflect. You can contribute to a Roth IRA if your Adjusted Gross Income (AGI) is: Less than $, (single filer) tax year; Less than $, (joint filer). You can contribute the full amount as a single if your income is less than $, However, if you are married your combined income must be. Income phase-out ranges that determine Roth individual retirement contributions. Roth IRA Contribution Limits Modified Adjusted Gross Income Phase-Out Ranges*. For , the total contributions you make each year to all of your traditional IRAs and Roth IRAs can't be more than: $7, ($8, if you're age 50 or older. It doesn't matter if you're covered by an employer's retirement plan, such as a (k) or (b). As long as you don't exceed the IRS's income limits, you can. Both spouses may contribute according to IRS limits, but a spousal IRA has only one legal account holder. Spousal Roth IRA income limits are set by the IRS. Roth IRA MAGI Limits ; Filing Status. Modified Adjusted Gross Income (MAGI). Contribution Limit ; Single or Head of Household. Less than $, Full. The maximum amount you can contribute to a Roth IRA for is $7, (up from $6, in ) if you're younger than age If you're age 50 and older, you. The combined annual contribution limit for Roth and traditional IRAs for the tax year is $7,, or $8, if you're age 50 or older. Those limits reflect. You can contribute to a Roth IRA if your Adjusted Gross Income (AGI) is: Less than $, (single filer) tax year; Less than $, (joint filer).

Roth IRA - Am I Eligible?Collapse · Full contribution if MAGI is less than $, (single) or $, (joint); Partial contribution if MAGI is between. Your modified adjusted gross income (MAGI) determines whether you are eligible to make a contribution to a Roth IRA at all. MAGI limits are subject to. If your modified adjusted gross income (MAGI) is more than $, for married joint filers or $, for single filers, you cannot make a Roth contribution. You must have earned income (compensation) in order to contribute to a Roth IRA. There is no age restriction to contribute to a Roth IRA as long as you have. All head-of-household filers must have incomes of $57, or less in Single taxpayers must have incomes of $38, or less in The amount of credit. Roth IRAs · Single individuals with MAGI of $, or less may contribute the maximum annual contribution ($7,, plus catch-up contributions, if eligible) to. Am I Eligible?Expand · Full contribution if MAGI is less than $, (single) or $, (joint) · Partial contribution if MAGI is between $, and. #3: You must stay below income limits to contribute to a Roth IRA If you file taxes as a single person, your modified adjusted gross income (MAGI) must be. Roth IRA Income Limits & Phase-Out Ranges ; Filing Status, MAGI Range for Reduced Contribution, MAGI Range for No Contribution ; Single, $, - $,, More. Traditional and Roth IRA. Annual Contribution Limits. , Age 49 and under, Up to $7, Key takeaways · The Roth IRA contribution limit for is $7, for those under 50, and $8, for those 50 and older. · Your personal Roth IRA contribution. If you are single, you must have a modified adjusted gross income (MAGI) under $, to contribute to a Roth IRA for the tax year, but contributions are. Is phased out completely when your income is more than $, if you are Single or Head of Household, or $, if Married Filing Jointly; Married couples. tax year: $ per individual ($ if age 50 or over) or percent of your earned income, whichever is less. Spousal Contributions: The maximum. Contribution limits for traditional and Roth IRAs are combined Keep in mind that if you have both a traditional IRA and a Roth IRA, the contribution limit for. There are income restrictions on the Roth. If you are single, your income must be less than $95, (MAGI - modified adjusted gross income) in order to be. Currently, Roth contribution limits for those under 50 are $6, and $7, for those 50 and older. Unlike with the Traditional IRA or (k), contributions. up to % of includable compensation (must be less than the elective deferral limit), or; for those with employer matches or other employer contributions. Roth IRA Rules: Income and Contribution Limits · $ if your income is low enough (and $ if you're 50 or older) for · $ more than that for These limits, updated annually, apply to traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, individual (k) plans, HSAs, and ESAs. For detailed information.

Does Consolidating Your Debt Hurt Your Credit

Will Debt Consolidation hurt my credit score? Most people entering a DCP already have a low credit score. While a DCP could lower your credit score at first, in. Depending on your credit profile, a debt consolidation loan could help improve your credit by diversifying your credit mix and showing that you can make on-time. Debt consolidation also generally won't hurt your credit in the long run, and it may even help your scores grow. But it's more difficult to say what the. Generally speaking, having a debt consolidation loan will not have a negative impact on your ability to refinance your home or obtain a new mortgage. In fact. You qualify for a lower interest rate If you're struggling to get out of debt but still have good enough credit to qualify for a debt consolidation loan with. This initial (soft) inquiry will not affect your credit score. If you accept your rate and proceed with your application, we do another (hard) credit inquiry. “Consolidating debts does not have a direct impact on your credit scores, but it can be a helpful way to protect your financial standing,” says Rod Griffin. It should be emphasized that when provided by the right lenders and managed carefully, consolidation loans don't hurt your credit. They're designed to help you. Debt consolidation will temporarily lower your credit score because you're accessing additional credit. Any lender will make a “hard inquiry” on your credit. Will Debt Consolidation hurt my credit score? Most people entering a DCP already have a low credit score. While a DCP could lower your credit score at first, in. Depending on your credit profile, a debt consolidation loan could help improve your credit by diversifying your credit mix and showing that you can make on-time. Debt consolidation also generally won't hurt your credit in the long run, and it may even help your scores grow. But it's more difficult to say what the. Generally speaking, having a debt consolidation loan will not have a negative impact on your ability to refinance your home or obtain a new mortgage. In fact. You qualify for a lower interest rate If you're struggling to get out of debt but still have good enough credit to qualify for a debt consolidation loan with. This initial (soft) inquiry will not affect your credit score. If you accept your rate and proceed with your application, we do another (hard) credit inquiry. “Consolidating debts does not have a direct impact on your credit scores, but it can be a helpful way to protect your financial standing,” says Rod Griffin. It should be emphasized that when provided by the right lenders and managed carefully, consolidation loans don't hurt your credit. They're designed to help you. Debt consolidation will temporarily lower your credit score because you're accessing additional credit. Any lender will make a “hard inquiry” on your credit.

You use this loan to pay off your credit card debt, then repay the loan in monthly installments, usually with a lower interest rate than you were paying on your. Debt consolidation can simplify your finances, lower your interest costs, convert variable credit card interest rates to a single fixed rate, and create a. Debt consolidation can positively impact your credit score by lowering your overall credit utilization ratio. By paying off multiple credit card balances with a. Having a debt consolidation loan on your credit report won't look different to any other kind of loan. As long as you make your repayments on time, it won't. Debt consolidation could either help or hurt your credit score. Here's how to minimize the downside while maximizing the upside. On-time payments have the most credit score impact. Debt consolidation should lower and streamline monthly payments, meaning you can make them on time. You will. On-time payments have the most credit score impact. Debt consolidation should lower and streamline monthly payments, meaning you can make them on time. You will. Understand, however, that debt consolidation can hurt your credit score, at least in the short term. Does Credit Card Debt Consolidation Hurt Your Credit? Debt. 1. Before you apply, we encourage you to carefully consider whether consolidating your existing debt is the right choice for you. Consolidating multiple debts. If you find yourself struggling, consolidating your credit card debt could be one way to simplify and lower your payments. Keep reading to learn a few methods. May offer lower interest rates than what you're currently paying. Can reduce the size — and number — of monthly payments. Could improve your credit score if. While debt consolidation is mainly a method of lowering or eliminating mounting debt, it can also have a positive effect on your credit score. Does credit card consolidation hurt your credit score? Credit card consolidation can hurt your score initially and temporarily, but is designed to help your. Generally, it's not a good idea to max out your credit card. If you do use up your entire credit limit on your card, you'll discover that your credit score may. Debt consolidation loans just show up as a loan, not the purpose for the loan. Bank/credit union loans will be slightly better for your score. So, that's the tradeoff that creditors expect. You can't make any new charges on your existing accounts or get new credit cards until you complete the program. Applying for new credit. Applying for new credit will always affect your credit score. A debt consolidation loan is considered a new form of credit. The lender. Key Takeaways: · Debt consolidation loans may cause slight, short-term dips in your credit score. · In the long-term, debt consolidation may actually help to. The impact of debt consolidation on your credit score can be viewed from a short-term and long-term perspective. In the short term, applying for a consolidation. A Debt Management Plan does not affect your credit score negatively in any way, and can also help to improve it if payments are made on time. The balance.

Information About Vehicle Loan

We're here to help. Customer Service Center. Find information on managing your PNC auto loan account. You must have a deposit account with Regions that has been open for at least six months in order to be eligible for an automobile loan. · As of 9/6/23, annual. A good rule of thumb is to keep the price of the car at less than 10% of your gross annual income. An auto loan is a significant debt that will be on your. The results shown are based on information and assumptions provided by you regarding your goals and financial situation. Applicability or accuracy regarding. Buying a new car? Refinancing your existing loan? Our competitive auto loans are as low as % APR.** We even provide a free concierge car finding service. A vehicle purchase is a smooth drive with great car loan interest rates, various loan terms, and less fees than the other guy. Apply online · Schedule an. Shopping for a car? If you need a auto loan, find out how much you can borrow, and compare financing options. Calculating your payments is easy! How fast can I be approved for a vehicle loan? Can I be approved the same Please visit Lease Maturity's website (boxportal.ru) for more information. Your credit report has information that affects whether you can get a loan — and how much you'll have to pay in interest to borrow money. Get an “out-the. We're here to help. Customer Service Center. Find information on managing your PNC auto loan account. You must have a deposit account with Regions that has been open for at least six months in order to be eligible for an automobile loan. · As of 9/6/23, annual. A good rule of thumb is to keep the price of the car at less than 10% of your gross annual income. An auto loan is a significant debt that will be on your. The results shown are based on information and assumptions provided by you regarding your goals and financial situation. Applicability or accuracy regarding. Buying a new car? Refinancing your existing loan? Our competitive auto loans are as low as % APR.** We even provide a free concierge car finding service. A vehicle purchase is a smooth drive with great car loan interest rates, various loan terms, and less fees than the other guy. Apply online · Schedule an. Shopping for a car? If you need a auto loan, find out how much you can borrow, and compare financing options. Calculating your payments is easy! How fast can I be approved for a vehicle loan? Can I be approved the same Please visit Lease Maturity's website (boxportal.ru) for more information. Your credit report has information that affects whether you can get a loan — and how much you'll have to pay in interest to borrow money. Get an “out-the.

vehicle loan, but you can submit your loan application before finalizing membership. If you are not yet a DCU member, you will receive information about how. Information about vehicle repossession. What is a vehicle repossession?Expand The dealership will assist you in purchasing a new vehicle and creating a new. Day No Payment Information. Offer subject to change at any time. Finance charges begin accruing as of the loan origination date, other restrictions may apply. Simply complete a loan application based on the age of the vehicle you are considering, as well as the maximum loan amount you want. If you are unsure of how. Interested in buying a car? Visit our page and discover features & benefits offered at TD to help you find the best auto loan option for you. For information, contact our Auto Loan Advisors at Easy Online Access. When you have an Auto Loan with Credit Human, you get up-to-the minute. What's the Process For Auto Loans Through Credit Unions? · 1. Apply For A Loan. You have multiple options when you apply for a credit union auto loan, being. You can also expect to provide your Social Security number and vehicle information. Know in advance what to bring when applying for an auto loan so you can. Financing through Commerce Bank is a straightforward process with no loan fees or early payoff fees. Additionally, you may qualify for an even lower payment. Yes, our rates apply to all model years. Visit our rates page for more information. Can I finance a vehicle I buy from an individual? Yes, we will need to. At its most basic, an auto loan is a form of credit. You borrow money from a lender to use toward the intended purchase — in this case, buying a car — to be. Applying for an Auto Loan · Contact information (phone number and email) · Current housing, employment and income information · Any vehicle trade-in information . With a vehicle lease buyout auto loan, you can make your ride your own. All loans are subject to credit approval. Loan application requires vehicle information, as well as driver's license number, issue date, and expiration date for. Where to get a motor vehicle loan · Banks and credit unions, including both state and federally chartered banks and credit unions, will generally offer auto. Submit an online loan application or apply by phone at (available 24/7). We will process your application and notify you when your preapproval is. Determine whether the loan has a fixed rate (monthly payments and rate remain the same) or an adjustable rate (monthly payments and rate can change). Your. Once you settle on a car, you will select the best loan offer, submit a detailed application, and then wait for the lender to verify your information and. If you're currently driving the car of your dreams, but you financed it elsewhere, refinancing your auto (or other vehicle) loan with us can help you save each. Find the right vehicle loan for your new or used vehicle. KeyBank has vehicle Access loan information and balance with online banking; Eligible for.